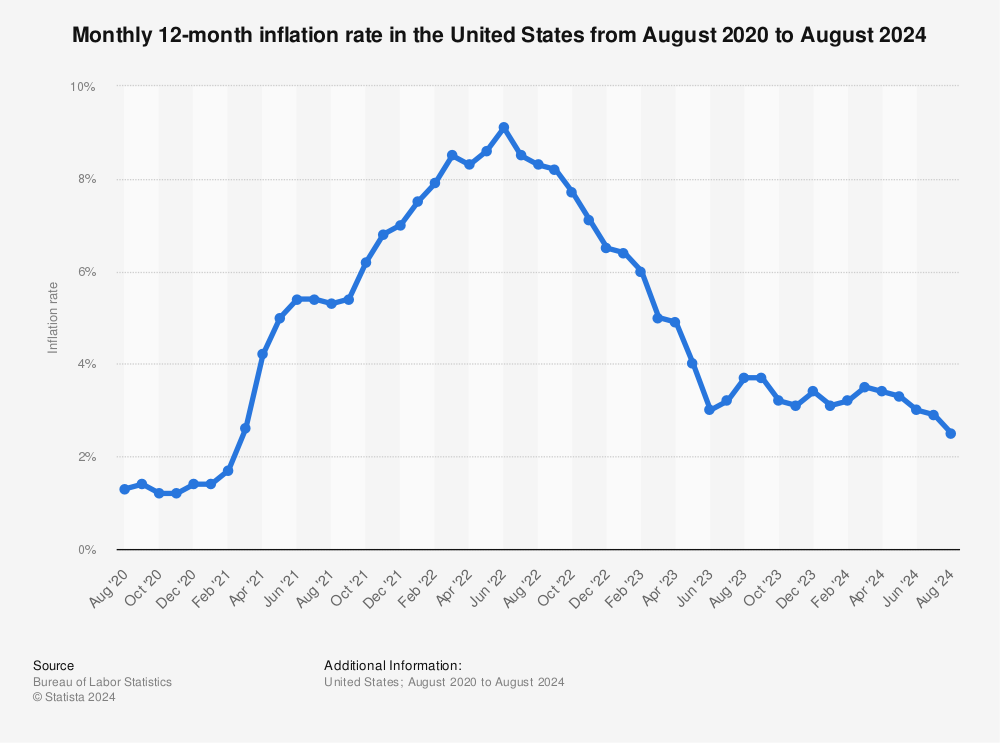

There are countless prognostications on the "inevitable" drop in mortgage rates, and for good reason. The mortgage market had a treacherous 2023, full of rate hikes from the Fed in response to the record 9.1% inflation rate of June 2022. In its zeal to curb inflation, mortgages became one of the Fed's casualties. The real estate market was noticeably affected, as all activity slowed. This recent article on Investopedia does a great job explaining the past 18 months of mortgage market activity, putting the market into historical perspective. At this point, any news of relief in the mortgage market is seen as a beacon of hope. The fact that the Fed has succeeded in lowering inflation, as indicated by graph below, only adds to the anticipation that good news is on the horizon.

The news of lower inflation is sweet music to the country's ears. Real estate professionals in particular love to hear about lower inflation, because it is the precursor to lower interest rates and everyone loves lower interest rates. Borrowers love lower mortgage rates because

they lower mortgage payments and allow for increased purchasing power. Property

owners appreciate a lower interest rate market, because it increases the number

of purchasers available in the market, it makes closing a deal faster and more

seamless and it allows them to purchase more with the money that they gain from

selling their property. There is, however, a less intuitive question: why do

lenders prefer a lower interest rate market? Thankfully, there is a simple answer—although lower rates mean less interest on each mortgage, lower rates

increase volume. More importantly, even at low interest rates, with mortgages,

the lender always wins and wins big.

Big Windfall

A 30-year mortgage carried to term is indeed one of the best investments that exists. Calculated using the simplest terms possible, a traditional mortgage paid to term can yield triple digit percentage returns in interest alone, as outlined in the table below. A mortgage paid to term at 6% or higher will cause the borrower to pay more than double the principal. Numbers like this are enough to make any investor run to invest in mortgages or become a lender themselves, but the gains become more modest when considering inflation.

|

$300,000 Mortgage |

|||||||||||

|

Mortgage Rate |

Total Paid Over Loan Term |

Total Interest Paid Over Loan Term |

Interest Paid as a Percentage of

Principal |

Present Value of Total Paid at 4%

Inflation |

Present Value of Interest Paid at 4%

Inflation |

Interest Paid as a Percentage of

Principal at 4% Inflation |

|

||||

|

4% |

$515,610.00 |

$215,610.00 |

71.87% |

$442,716.85 |

$142,716.85 |

47.57% |

|

||||

|

5% |

$579,765.60 |

$279,765.60 |

93.26% |

$483,811.47 |

$183,811.47 |

61.27% |

|

||||

|

6% |

$647,514.00 |

$347,514.00 |

115.84% |

$526,724.94 |

$226,724.94 |

75.57% |

|

||||

|

7% |

$718,527.60 |

$418,527.60 |

139.51% |

$571,257.46 |

$271,257.46 |

90.42% |

|

||||

|

8% |

$792,360.00 |

$492,360.00 |

164.12% |

$617,207.57 |

$317,207.57 |

105.74% |

|

||||

*Property of the Real Estate Think Tank.com

The table above predicts the present value of a $300,000 30-year mortgage paid to term,

assuming static 4% inflation. Although the

historical US inflation rate is 3.3%, and inflation hit

a peak of 9.1% in June of 2022, most

recent inflation statistics put current inflation around 3.2%. In light of

these figures, the 4.0% estimation used is conservative. Once adjusted,

the percentages are certainly lower, as money devalues over time, but they are

by no means unattractive. Lending is a lucrative business and so ingrained in

American culture that most borrowers do not understand the trade-off that they

are making and those that do, do it anyway.

There are few purchases that can justify paying an extra 50% for

them and fewer are worth paying for them twice. That said, appreciation more

than mitigates the costs of borrowing for a property purchaser. Real estate

returns average between

9.5% and 10.6%, depending on the type investment. A mortgage, therefore, is

a much an attempt to capture some of the appreciation of a property as it is a

loan to facilitate acquisition. Savvy investors, however, have learned to

mitigate the amount of appreciation that a lender can capture through increased

downpayments, prepayments, refinancing and a myriad of other methods. In light

of these attempts at managing mortgage expense, the spread offered above

market, the liquidity of the instrument, the relatively high priority of rights

to the property and the overall payments structure make a well-vetted mortgage

a great investment for the lender.

The Spread

Mortgages are designed to make money for their lenders and the

mortgage market ensures that they do so. Mortgages typically trade at a spread

over the yields of 10-year Treasury bonds, abbreviated as 10-yr T-bills. This is a

well-known, often-quoted, fact. The aspect of mortgage-10-yr T-bill

relationship that is less discussed publicly is that

mortgage spreads and T-bill yields have an inverse relationship. This means

that as mortgage rates drop and volume increases, the amount of extra

percentage points lenders charge over a T-Bill yield increases. Conversely,

as T-Bill yields increase, spreads decrease, but as shown above, the amount of

interest paid increases, as the mortgages given in these markets have higher

rates. Furthermore, these rates are locked in for up to 30 years, meaning that

if paid to term, a lender will receive the higher rate, even if the yield of

the 10 yr T-Bill drops to 2%. In this way, mortgage lenders profit in any

interest rate market--either from volume and increased spread, when rates are

low or from increased interest when rates are high. Interestingly, now is a

particularly advantageous time for mortgage lenders. Mortgage spreads seem

to remain high, despite T-bill yields dropping. This is a unique situation that

makes lending more lucrative and borrowing more expensive in the current market.

The Liquidity

It is no secret to readers of this blog that mortgages are easily

bought and sold on the secondary market. There are two types of secondary

markets for mortgages--private and institutional. The private secondary market

consists of the local note buyers in a community that acquire

individual private mortgages. The institutional secondary market is the place

where mortgage lenders sell the bundle of mortgages they originate to banks,

different types of funds and other entities in exchange for more cash to lend.

It's also the place where different financial institutions trade whole loan

portfolios. There are several articles about the secondary mortgage market on

this blog, which can give more context on its purpose and activity. The fact

remains, however, that there is an active market in which buyers and sellers

are readily trading mortgages. That said, there is no question that one of the

most cost-effective ways to transfer a property is by selling its mortgage.

Doing so carries low property risk and the promise of cashflow. Interestingly,

since most mortgages are recorded with land records, a mortgage transfer theoretically

could take the same amount of time as closing a house for cash. Mortgage

transactions, however, are usually much faster than property closings, because

the due diligence process for a mortgage is less involved than the process of

vetting a property.

High Priority Rights

The reason that a transfer of a mortgage can be considered a

transfer of a property is that primary mortgages, if originated properly, are

either in the first lien position or, in title theory states, are held by the

lender in a trust for the benefit of the borrower. Essentially, this means that

holding a mortgage is like the lender having a right of first refusals that the

borrower pays to maintain. If the borrower is unable to pay, the primary

mortgage holder has the strongest ability to claim the property that wipes out

any junior lien holders upon execution. The rights of the primary mortgage

holder can only be trumped by the local government, who can wipe out any lien

holder, including a mortgage holder, for unpaid taxes. Holding a primary

mortgage is as close as you can to the property without owning it.

Payment Structure

With a mortgage, the lender gets paid first. This is because all

mortgages are front-loaded with interest until the reversion point--the

point at which most of the payment stops going to pay down interest. The time

it takes for a mortgage payment to consist of more principal paydown than

interest is listed in the table below and rises as the interest rate of the

mortgage increases. Viewed from this perspective, the effect of a higher

interest rate is not merely increased monthly payments, but also significantly

increased interest paid overall and a longer period during which interest

dominates the monthly payment. The length of time before reaching the reversion

point can further be reduced by choosing a shorter mortgage term at the outset.

|

Mortgage Rate |

Reversion Payment |

Number of Years Until Reversion |

|

4% |

153 |

12.75 |

|

5% |

195 |

16.25 |

|

6% |

223 |

18.58 |

|

7% |

242 |

20.17 |

|

8% |

257 |

21.42 |

*Property of the

Real Estate Think Tank.com

The Refinance Trap

Ultimately, this

article can be read in two ways--it can be viewed as an overture to investors,

explaining the benefits of becoming a real estate lender or investing mortgages

or it can be seen as an advisory to borrowers about the lopsidedness of the

mortgage instrument in favor of the lender. Either way, one thing remains

true--with mortgages, the lender wins.

No comments:

Post a Comment